capital gains tax changes 2021 canada

The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate. The medium-term plan is to reduce taxes to the extent that 11.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

If these changes become law as proposed or announced they will be effective for 2021 or as of the dates given.

. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. The basic exemption amount remains at. In absolute amounts an individual employee will contribute 26845 more in 2021.

In Canada 50 of the value of any capital gains are taxable. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Generally capital gains are taxed on half of the gain.

When this minimum tax is greater than the net federal tax it replaces the net federal tax and for. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on. Capital Gains Tax Rate.

This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in the top marginal tax bracket ie with taxable income in excess of 216511 for 2021. For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. Guidance on affidavits and valuations Bill C-208.

Youre then taxed based on your particular provinces tax bracket. Bill C-208 amends capital gains stripping and anti-surplus rules related to transfers of small business or family farm or fishing corporation Executive summary On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal Assent. Its been paying dividends for more than 140 years and increased the payment for 25 consecutive years.

For more information see What is the capital gains deduction limit. The maximum pensionable earnings is 64900 an increase of 3300 from the 61600 in 2021. Self-employed individuals must contribute 633290 not.

Capital gains tax rates by province below. In Canada 50 of the value of any capital gains is taxable. As of September 7 2021 the share price is 3397 a.

The CRA has recently announced that the maximum pensionable earnings under the Canada Pension Plan CPP will be 61600 in 2021. In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add 50 of the capital gains to your income. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income.

Thats a whopping 49 higher than the 58700 ceiling in 2020. Accordingly the actual income that you would be taxed on at your marginal tax rate would be 1750. The amount will reduce if a.

At 22 your capital gains tax on this real estate sale would be 3300. Income will reduce by 316645 each instead of 2898. Both taxes will take effect on Jan.

Lifetime capital gains exemption limit. Also noted are changes to income tax rules including those that were announced but not yet law when the Income tax package was published in November 2021. The CRA enhanced the Basic Personal Amount BPA in 2021 allowing Canadian taxpayers to save 570 from the incoming tax bill.

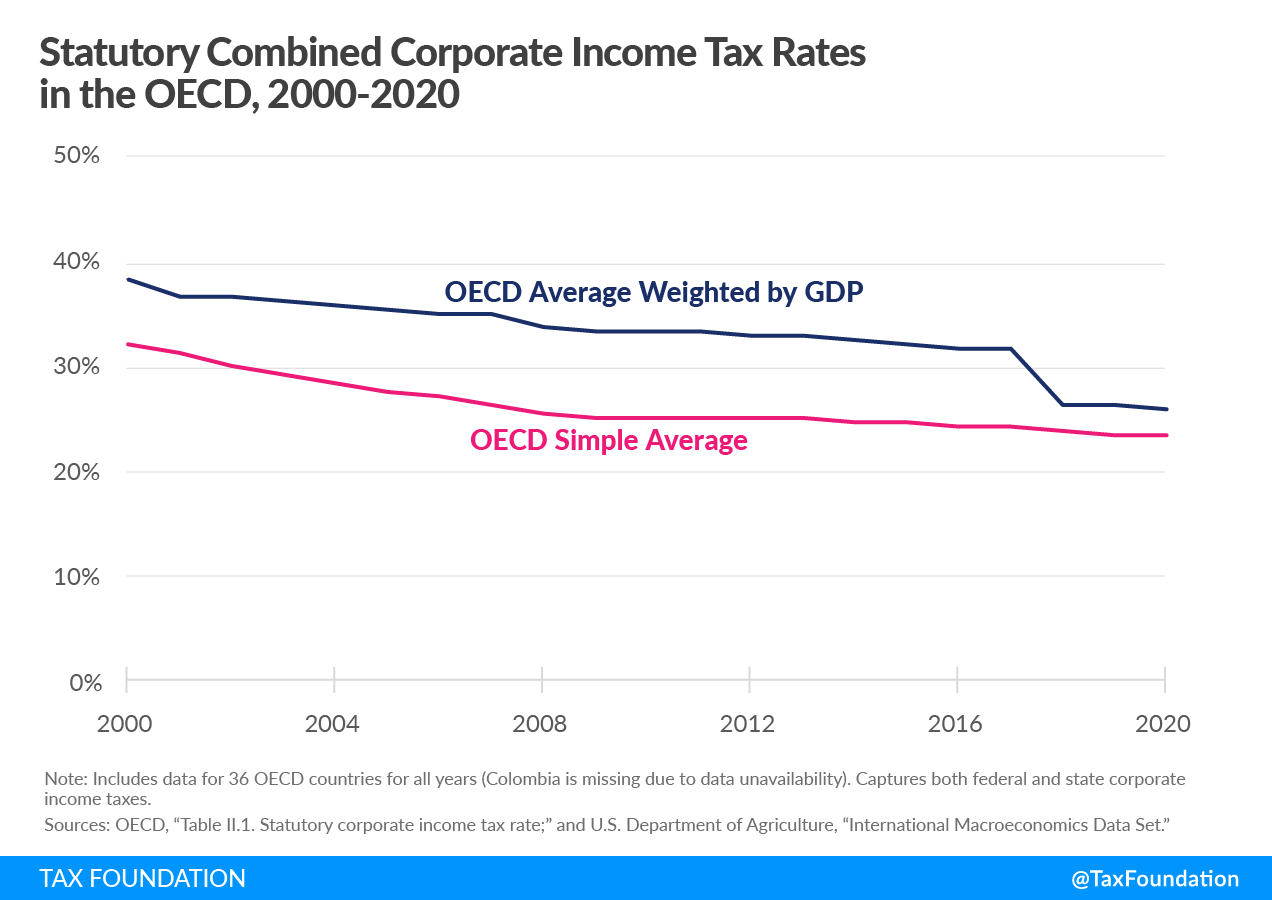

Tax changes and improvements to services are noted on this page. Our recent study found that Canada ranks 22 nd out of 36 industrialized countries for our capital gains tax rate which at 27 is higher than key competitors including the United States 20 and. Details on a new 1 annual tax on the unproductive use of Canadian housing by foreign owners will come in the months ahead he said.

For tax purposes the gain would only be half of 35. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10 12 22 24 32 35 or 37. If your income in 2021 will not exceed 151978 you can earn up to the new BPA before paying federal tax.

The tax is calculated at the lesser of 20 of the value above those thresholds or 10 of the full value of that car boat or personal aircraft Golombek said.

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Difference Between Income Tax And Capital Gains Tax Difference Between

How Much Tax Will I Pay If I Flip A House New Silver

Capital Gains Tax In Canada Explained Youtube

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Canada Tax Income Taxes In Canada Tax Foundation

Canada Tax Income Taxes In Canada Tax Foundation

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 Capital Gains Tax Rates In Europe Tax Foundation

Restricted Stock Units Jane Financial

Canada Tax Income Taxes In Canada Tax Foundation

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Ucp Remove Film Tax Credit Cap They Created Tax Credits Tax Cap

Capital Gains Tax What Is It When Do You Pay It

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Capital Gains Tax What It Is How It Works Seeking Alpha

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation